For the 12th time this year, mortgage rates have hit a record low. The 30-year fixed-rate mortgage fell to an average of 2.78%, the lowest ever recorded in Freddie Mac’s books dating back to 1971.

Sam Khater, Freddie Mac’s chief economist, attributed the record-low rates this week to “economic and political ambiguity."

"Despite the uncertainty that we’ve all experienced this year," he said, "the housing market, buoyed by low rates, continues to be a bright spot."

Consumers are saving much more than they were before the rise of the pandemic—nearly 14% of their disposable income, according to the National Association of REALTORS®. Personal income also rose 6% in September compared to a year earlier. “With people saving more than ever before, home buying is more attractive, although home prices continue to rise,” writes Nadia Evangelou, a research economist, on NAR’s Economists’ Outlook blog. “Meanwhile, these ultra-low mortgage rates significantly lower mortgage payments, making housing more affordable than a year earlier in many areas.”

For example, in the Washington, D.C., metro area, home prices have jumped nearly 12% compared to a year earlier, Evangelou says. However, due to low mortgage rates, the monthly payment on a 30-year fixed-rate mortgage is lower than a year ago, averaging $1,820.

The housing market is also getting a boost from an improving job market. This week’s labor market report showed that the U.S. added another 638,000 in net job gains. The unemployment rate now stands at 6.9%. Since the April lockdown from the COVID-19 pandemic, about 12.1 million jobs have been recovered. Another 10 million jobs are needed to return to pre-pandemic levels, says Lawrence Yun, NAR's chief economist. Residential construction and contracting trades added a major bulk of the jobs last month at 23,800, Yun says.

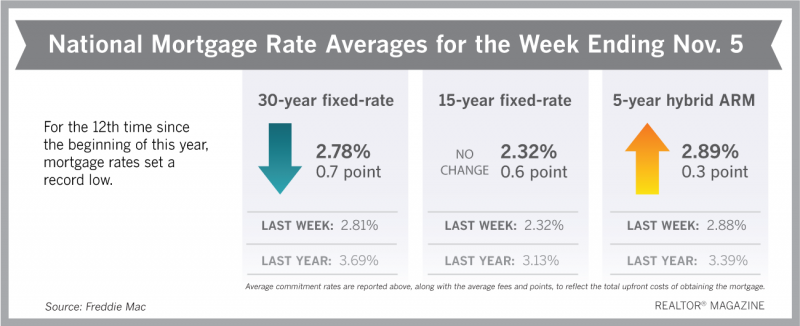

Freddie Mac reports the following national averages with mortgage rates for the week ending Nov. 5:

- 30-year fixed-rate mortgages: Averaged 2.78%, with an average 0.7 point, falling from last week’s 2.81% average. The previous all-time low for the 30-year fixed-rate mortgage was set in October with an average of 2.80%. A year ago, 30-year rates averaged 3.69%.

- 15-year fixed-rate mortgages: Averaged 2.32%, with an average 0.6 point, unchanged from last week. A year ago, 15-year rates averaged 3.13%.

- 5-year hybrid adjustable-rate mortgages: Averaged 2.89%, with an average 0.3 point, rising slightly from last week’s 2.88% average. A year ago, 5-year ARMs averaged 3.39%.

Freddie Mac reports average commitment rates along with points to reflect the total upfront cost of obtaining the mortgage.

Source: National Association of REALTORS® and Freddie Mac