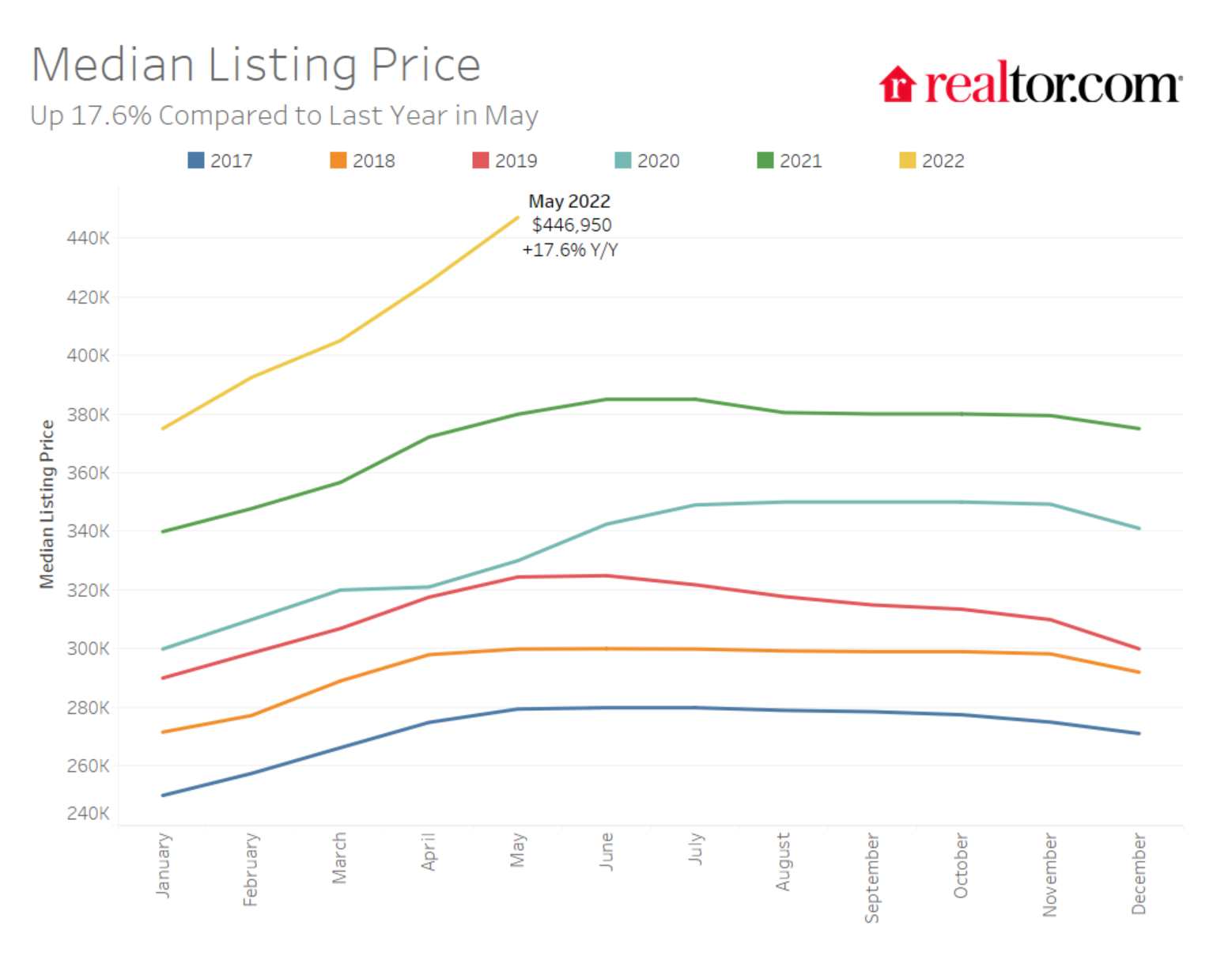

The median national home price climbed to an all-time high in May, reaching $447,000, realtor.com® reports. Buyers snatched up listings a week faster than a year ago. But despite higher prices and faster sales, housing analysts say there are signs of a slowing housing market.

Active inventory rose 8% annually—the first time that benchmark has been reached in nearly three years, realtor.com®’s monthly housing trends report shows. A rising number of homeowners may be growing more confident in selling.

“Among key factors fueling the inventory comeback are new sellers, who are listing homes at a rate not seen since 2019, as well as moderating demand, with pending listings declining year-over-year in May,” says Danielle Hale, realtor.com®’s chief economist. “While this real estate refresh is welcome news in a still-undersupplied market, it has yet to make a dent in home price growth, partially due to increases in newly listed, larger homes and because the typical seller outlook is quite high, likely shaped by recent experiences of homeowners who sold.”

The increase in inventory, coupled with signs of softening buyer demand, typically would drive home prices lower. However, that was not the case last month. Researchers say causes include the rising share of newly listed, larger homes and sellers not yet adjusting to shifting supply and demand dynamics.

Average listing prices in the nation’s largest metros rose by 13% compared to a year ago. The largest gains were recorded in Miami (up 45.9%); Nashville, Tenn. (up by 32.5%); and Orlando, Fla. (up by 32.4%), according to realtor.com®.

While home prices are still hitting new highs, the pace of appreciation is not likely to continue, Lawrence Yun, chief economist at the National Association of REALTORS®, said in an interview on CNBC’s “Power Lunch” this week. “It’s just inevitable that home price appreciation will slow down in the upcoming months,” Yun told CNBC.

Source: realtor.com®